Brad DeLong linked to a review of the neuroeconomic foundations of choice for his class and Noah Smith posted about unstable preferences. The information transfer model, though, takes an agnostic view of what people think. People are communicating something to the market by purchasing a bag of apples at the grocery store for $5, but we really can't be sure of what that is. Maybe they think it's a deal. Maybe it isn't a deal, but the store where they are cheaper is far away. People will create rationalizations for their choices that may or may not have anything to do with the real reasons.

In essence, a decision to purchase an asset at a price p can only communicate so much information. Typically humans pay attention to the left-most digits and the decimal place Although prices ending in 99 may have come to signal "on-sale" or "bargain" whereas whole number prices tend to signal "luxury" (just look at a menu for a fancy restaurant). This is an evolved conditioning ... the 99 didn't always mean that ... which makes the point even more forcefully that we can't be certain of what someone is thinking when they purchase at a given price. One thing we can be certain of is that a price p only transfers ~ log p bits of information**. These bits may represent compressed information (like the 99 heuristic above), but then you'd have to account for channel coding, error-correction, etc which means that even less actual information is coming through the channel -- this number is a bound.

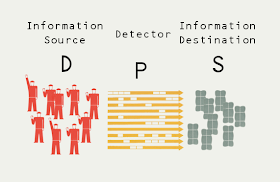

That is to say that the quantity of information being transferred from the demand paying that price to the supply accepting that price that is being aggregated by the market is far larger than can be communicated by a number. And that's the key. That number is just detecting the information being transferred. It tends to go up when a lot of people want apples e.g. for pies or just to sit on your counter and make you feel like you have a healthy diet; it goes down when there are a lot of apples to go around. It is aggregating information about weather and food trends; it is not communicating that information.

That is why I think the idea of modelling macroeconomics as agents with preferences -- even if those preferences are modeled on human behavior -- is doomed. If you think too much information has been destroyed in aggregating the price of apples, then imagine how much has been destroyed in aggregating all the prices in an economy? Too much information has been destroyed in the aggregation that it couldn't possibly matter what any particular agent was thinking. Noah Smith says macroeconomic data is "uninformative". I think this is the reason. A series of NGDP numbers can't tell you much of anything because almost all of the information being transferred in the economy has been destroyed in the aggregation.

Wait. Couldn't possibly matter? I slipped that one in there. Because we know that it can matter: economic bubbles, for example. Ah, but that is when the behavior of agents becomes highly correlated. And since people are complex, that correlation likely happens in a single dimension (or low dimensional subspace), making it the only one that matters. Or another way, when the detailed information about individual agents' preferences and behavior is destroyed, that behavior might become tractable. I think this is the key to understanding economics. Economics may be tractable only when agents' individual behavior is irrelevant.

I brought this up near the beginning of this blog:

One could take this further and make the argument that

Only when the aggregation of information into well-defined prices alongside the destruction of the details in the microfoundations occurs can we say that we are studying economics. In the quote from my earlier post I make the analogy with thermodynamics. Essentially it ways that when the behavior of individual atoms matters, it stops being thermodynamics.

This is the assumption in the information transfer picture of economics. There are no agents, only ensembles of information. How good is this assumption? Well, it seems to find the trends, but doesn't explain correlated deviations:

But correlated deviations seem like the best opportunity to use behavioral economics! Agent behavior becomes relevant, but only a low dimensional subspace of that behavior. Call it the mob or muddle heuristic: either behavior is super-organized with a single relevant dimension (mob = deviations) or it is totally disorganized (muddle = trend). The key is to get the right trend, and that's where I hope that the information transfer model can help.

** For widgets. For commodities, there is effectively a price per unit weight/volume/etc opening up the possibility of effectively tiny fractions of a cent. However, this just represents a linear shift in the logarithm.

.png)

+2.png)

+2a.png)

+3b.png)

+mb+0.png)