I have an article up at Evonomics about the basics of information equilibrium looking at it from the perspective of Hayek's price mechanism and the potential for market failure. Consider this post a forum for discussion or critiques. I earlier put up a post with further reading and some slides linked here.

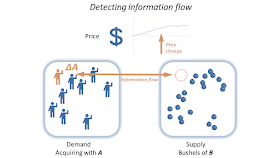

I also made up a couple of diagrams that I didn't end up using illustrating price changes:

I find your Evonomics article very thought provoking. Deep enough that I must read and absorb the content over time.

ReplyDeleteTwo quick reactions:

1. It seems to me that demand is also a coin flip. Why? Coins represent the trading medium; one side has coins, the other wants coins. This brings us to a decision point:

Both sides must -simultaneously- reach a decision to trade. This means that it is not the number of coins that dictates trading; it is the number of simultaneous decisions. ("simultaneous" means "within the time period measured")

2. I do not know if the sun will rise tomorrow at 6:02 AM but based on past history, I can predict the time of rising with great accuracy.

On the other hand, I can decide to take my first bite of breakfast at 6:02 AM, and maybe make it happen. My decision has some predictive power but has no history to allow confidence in accuracy.

Your Evonomics post (for me) involves ideas that need to be meshed with my concepts. The meshing is not automatic (terms and time periods mainly), so thought is required. A pity that time is in such short supply.

Cheers and thanks for reading.

DeleteRegarding your point 1) above, that is what I wrote. Both supply and demand are "coin flips" that meet to make a transaction. I used coin flips as a metaphor to help people's intuition, but more generally we have a "supply event" and a "demand event" meeting to form a "transaction event".

Regarding 2), one of the things that is important in the information equilibrium framework is that you have many many events. We aren't talking about a single sunrise or a single breakfast, but thousands of sunrises and thousands of breakfasts. Once you focus in on a single "event", the information approach loses its descriptive power. We'd say the framework is "out of scope".

You have done a very nice job of introducing the Information Theory concepts here. Also, thanks for your comment to me--it was helpful.

ReplyDeleteI was please to read "now log(A) = k log(B) + b, where b is another constant." The b term is (I think) incredibly important but should be the subject of another post. Why would I think this?

Well, for some reason, the present condition of the sheep industry came to mind (as I read). As you must know, the raising of sheep has been an ongoing industry for thousands of years. Yet, under modern conditions, the sheep industry is in an advanced state of near collapse. Why? The unknowns (must be basic unknowns!) seem to be in a persistent negative feedback loop. Maybe modern society places some condition on the sheep industry (unrecognized condition(s)?) such as taxes or work requirements that the sheep industry simply can not overcome by pricing. Perhaps sheep have always been a marginal (economically) industry and have now become an obsolete technology, doomed to replacement.

Thanks for the presentation. I need to read it yet again and consider the "b" term a little more.

The b term is essentially the reference value -- for example if A and B are changing, then b is related to the value of B at some time t = t0.

DeleteYou can rewrite the equation as

log(A/A0) = k log(B/B0)

where A0 and B0 are constants (the values of A and B at t = t0). In terms of those constants "b" = log(A0) - k log(B0). In supply and demand language, shifts of A0 or B0 are shifts of the demand curve or supply curve (as opposed to movement along those curves).

Oh, and am I right that the b term could be composed of constants C + D + + + N?

ReplyDeleteIt is possible as any real number b can be rewritten as b = c + d. In reply to the comment above, I took b = log(A0) - k log(B0).

DeleteI am using the "Mercantile Money" model as a reference. Mercantile money is commonly known as a "gift certificate".

ReplyDeleteUsually gift certificates are traded for money by the issuing merchant. However, they could be directly traded for services. For example, a merchant could hire an electrician and pay him with a gift certificate.

Yes, the certificate is created out of thin air. Yes, the gift certificate is good only in the issuing store. It seems to me that government issued money has similar characteristics.

How does this fit with Information Transfer Economics? Money (which is information) has been traded for labor. Money is simply a record of labor performed.

Now when a merchant issues a gift certificate, it does not affect the prices of items in his store. It DOES effect the demand (sales) that his store will see.

It follows that a merchant can "give away the store" by issuing gift certificates in trade for labor. Such an action would not necessarily increase prices of the items in his store; it would only drain his store of merchandise.

This comment is not a challenge to your ideas. It is an attempt to mesh my concepts with your work.

The information equilibrium framework is somewhat agnostic about money. In general, and variables that are in information equilibrium can have that information mediated by money:

Deletehttp://informationtransfereconomics.blogspot.com/2015/05/money-defined-as-information-mediation.html

But the best models I've put together in this framework see "money" as more a factor of production just like labor or capital. If economies have high inflation, then it's similar to the quantity theory of money. If inflation is low, demographic and labor factors matter more:

http://informationtransfereconomics.blogspot.com/2017/03/belarus-and-effective-theories.html

The concepts are fitting together in a rather strange way:

ReplyDeletePrices and money are both information. Both prices and money are digitized so they are expressed as units. They either exist or not as representations of real objects.

From the aspect of human behavior, lower prices allows more VOLUME of trade--less price per item but more items traded. If nothing else, most people have less money, so lower prices allows more people to reach the asking price.

What about demand? Well, are talking about the demand for money or the demand for product? We usually think of demand in terms of numbers of product moved. That would follow the above pattern.

What about demand as a measure of price? That would make no sense. I guess the model would be out of scope. Price is information and not predictive of demand. That would explain my sheep industry example.

While demand may not be a measure of price, there remains a valid relationship as indicated above.

Now to read your two references.

It seems to me that the above description is consistent with your framework. The one additional thing that could be considered is the role of spurious signals.

Returning to the model of mercantile money, we find that money can be created spuriously by the merchant. There is no trade that precedes the issue of information. The issuance of mercantile money is information that a trade event has occurred. Once issued, mercantile money can be used and reused until it is finally redeemed by the issuing merchant.

I am beginning think that Information Transfer Economics and mercantile money fit together rather well.

Well, after reading your Evonomics post for about the fourth time, I doubt that you are comprehending my analog "mercantile money". I apologize for misreading your D (meaning Distribution) and thinking "Demand".

ReplyDeleteAfter this read, I think you are applying Information Transfer Economics to find the supply absorption-distribution in a range of the population. .

That said, I would still support everything I covered in the previous comment. While price will throttle distribution (between individuals ranked by wealth), I continue to think that price would be set by other factors such as complexity, taxes, and relative labor rates. (We need to explain the sheep industry and rare cars.)

We would have two theories where price is a variable. Information Transfer Economics models information as a throttle on distribution The second theory would consider prices and money as information in a digitized system.

I will be away from my computer tomorrow. I will continue thinking however.

Thinking about coin-flips before I leave. Do I have the correct interpretation?

ReplyDeleteWe have your distribution in the left drawing. We want to send that information to the right drawing the the form of bits.

Now I think about rules of observation and recording. We have N observers, each instructed to flip a coin if he sees a blueberry in a square. Each observer has a different rule to follow but only follows the rule if he sees a blueberry in a square.

The flip rule is one flip if you are observer one, two flips if you are observer two, three flips if ...... observer N.

It seems to me that each observer after observer one will give the identical distribution in probable flips but a different distribution in time or space.

The distribution reported by observer one would be perfect. Each later report would have errors. Despite each later report nearly guaranteed to contain errors, we could recover the perfect original information by averaging all the later reports, so long as each observer faithfully followed the basic rule that a "coin is flipped at each blueberry site".

Now if we had TWO blueberries on one site, we would need a different information system.

Just preparing for more thinking.

Hi Roger. How's it going?

DeleteRoger,

DeleteI'm not sure why you are introducing "observers"; the coin flip is a metaphor for the possible states of buyers and sellers.

No one can "see" a transaction that doesn't happen.

There is also no reason we can't have multiple blueberries or multiple buyers (or a single buyer of multiple blueberries) on each site.

Well, one of the features of digital communications is that improvement in the signal-to-noise ratio is achieved. The improvement continues until the transmitted signal is too weak to recover data packets. Then the signal completely disappears. This would be like the "it works until it doesn't work" phenomena found in markets and the economy.

DeleteIt seems to me that "observers" are the key to understanding this sudden break-off point.

If location is the only information transmitted, a simple on-off code can be sent. This would represent a single blueberry in a grid. With increasing observer numbers , we improve the data recovery, increasing the gathered signal strength.

When we come to more complex data, for instance a stream of numbers, then packets of information must be sent. The recovery of each packet must at least enough to move the probably-intended number above some acceptable percentage of possible error. An observer,either machine or human must make this judgement.

This reminds me of Schrodinger's Cat thought experiment.

I am thinking that price is far more data/information than a simple grid locate. Hence, price would require packet processing and an observer. The same with multiple entities on a single site.

It would be a breakthrough if Information Transfer Economics explained the "it works until it doesn't work" phenomena.

Is this making sense?

Hi Tom. Watch for an email containing answers.

DeleteWhile related to communication theory, we're not really dealing with a channel coding theorem (I have no idea what bandwidth means in the economic system, for example) where SNR matters:

DeleteC = B log(1+SNR)

No one is "coding" messages (a price change that goes up, then down, then up doesn't correspond to the letter "R" in Morse code.

Additionally, signals represent a lower information entropy (you are effectively spending energy to erase bits of randomness ... q.v. Landauer's principle).

We are looking at maximum (ideal) information transfer when there is maximum entropy (random occupation of states). It is probably better to look to information theory in thermodynamics than communications for metaphors.

However, the "works until it doesn't" concept is useful: the transition from ideal to non-ideal information transfer probably represents a correlation in state space (an example might be a financial panic, causing prices to fall). This is actually related to the second law of thermodynamics -- non-ideal information transfer represents a case where entropy spontaneously falls. This doesn't happen in thermodynamic systems (atoms can't spontaneously panic and fly to one side of the container, but people can panic and sell their stocks). There is no mathematical reason this can't happen in market systems ... and going by the familiar adage "anything that can go wrong, will" this means markets can spontaneously fail.

This is unrelated to SNR, however.

While SNR is limited by signal duration (we have a time limited amount of data (from which we can extract information)), I fear my communication metaphor has led us down an unintended path. Sorry about that.

DeleteI notice you have another post on this subject. Perhaps it it time to move on. That said, I have not yet meshed Information Transfer Economics with my own framework. Two tools, but how can they be used to give correlated results? My goal is correlated meshing of theories.

Hi Jason. Is that your first Evonomics article? Great to see you get your ideas in an article there.

ReplyDeleteCheers, Tom. And yes, it's my first at Evonomics.

Delete