It’s a kind of scientific integrity, a principle of scientific thought that corresponds to a kind of utter honesty—a kind of leaning over backwards. For example, if you’re doing an experiment, you should report everything that you think might make it invalid—not only what you think is right about it: other causes that could possibly explain your results; and things you thought of that you’ve eliminated by some other experiment, and how they worked—to make sure the other fellow can tell they have been eliminated.

I need to start off with what should become an obligatory statement noting that while Feynman was pretty good about describing what it means to participate in the process of science, he was also a sexist jerk and a prime example of toxic masculinity.

Anyway, I can't remember how I came across it a year ago (I think via Steve Roth), but the anonymous "random critical analysis" [RCA] is back in the econoblogosphere (it's still around, I swear!) — this time amplified by Alex Tabarrok at Marginal Revolution (not going to link). He's still peddling his wares. He claims:

Health spending is overwhelmingly determined by the average real income enjoyed by nations’ residents in the long run.

Emphasis in the original. I think it's a good example of how relying on an internet rando [0] to do quantitative analysis on major policy issues can lead us astray. It's also a good case study in how to identify the sometimes subtle choices that end up ensuring the conclusions as well as the sometimes even subtler hints that people are overselling their competence.

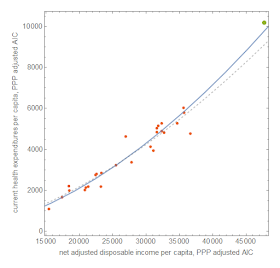

I have no idea why he emphasized "residents" because the rest of the sentence isn't exactly that precise. You could dig into the PPP adjusted AIC et cetera, but I'd first like to focus on the "determined". The next graph in the extended blog post is a log-linear regression that actually has no causal interpretation — health care spending is "determining" income as much as income is "determining" health care spending:

Just because you chose the x-axis to be income and the y-axis to be health care spending and performed a regression does not mean you've found a causal relationship that "determines" things. Certainly, there is likely some relationship! Per capita income of a country seems like a plausible variable in a model of health care expenses. In fact, it's what you'd expect if health care was becoming more and more unaffordable as costs outstrip the ability to pay for them (a mechanism that seems to be at play for housing prices in the US). RCA's big innovation is saying that instead of this being a problem, this is what people want.

RCA makes a big point about using log-log graphs in the opening paragraphs, but one of the problems here is that he shows only the log-log version of this graph because — as we'll see below — the linear version looks pretty silly. We'll also see that lines on log-log graphs help conceal the choice (and it is a deliberate choice) of a nonlinear function. However, there's also this:

In case you’re not already aware, these slopes [on log-log plots] can be readily interpreted in percentage terms. ... For example, the slope in the health expenditure-income plot below implies that a 1% increase in underlying value on the x-axis (income) predicts a 1.8% increase in value on the y-axis (health spending).

In reading this, I'm pretty sure that RCA doesn't actually understand that the 1.8 in that slope of the log-log graph means the growth rate of health spending is 1.8 times the growth rate in income. Sure, if incomes rise 1%, then health care will rise 1.8%. But if incomes rise 5%, then health care will rise 9%. Taking the difference in logs, you can substitute a (small) percentage in for x and get a percentage out as y, but you can't interpret the slope as a percentage unless that percentage is 180%. It's subtle, but it's the kind of thing you look for when teaching students because it helps you see if they understand the material or are just mechanically reproducing results.

I mean, in case you're not already aware [1] ...

Ok, next I have a bit of a nit — but it's kind of a theme of general sloppiness with RCA [2]. At that footnote we can learn a bit about orthogonal polynomials, but here we can learn a bit about significant figures. I was able to reproduce the graph above, but the equation in the annotation (like in the case in footnote [2]) gives an entirely different result (click to enlarge):

Blue is RCA's curve, gray dashed lines are my nonlinear model lines (either fit myself, or as above, using the equation RCA wrote down or rounding), and red is the data except for the US which is in green matching the original graph.

RCA rounded the two coefficients accurately (albeit to different orders), but it's really obvious we're on logarithmic axes when rounding from 9.88 to 10 moves you entirely off the data. RCA makes the claim that the fit is robust to leaving out the US, and if you look at the equations (especially if rounded by RCA's method) they are pretty close:

y = − 9.88 + 1.77 x with the US

y = − 9.68 + 1.75 x without the US

And that new equation (dashed gray) even looks pretty close on that log plot:

As an aside, this also tells us that RCA decided to do his analysis of the US not being an outlier in healthcare spending by including the US in the fits. That's just not how that works. Anyway, transforming back to linear space, we've gone down by 10% at US levels of income:

At 17% of GDP these days, a 10% reduction in health care spending in the US (~ 2% of GDP) would be a significant improvement! However, the US still isn't an outlier in this view — only about as much as Ireland. That's because this view is still effectively "a quadratic fit for no reason" that RCA was on about a year ago. If

y = a x²

then

log(y) = log(a) + 2 log(x)

The fits above show ~ 1.8 instead of 2 so we have x^1.8 instead of x^2, but we're still fitting a nonlinear function to the data. Why? As far as I can tell the only reason is that it tells the story the author wants.

This is where we get back to Feynman. Leaning over backwards with honesty would force us to ask why we should throw out a simple linear fit. It's not accuracy over range of the data — unless we're already assuming the US is not an outlier and including it in the fits.

Over the non-US data, the linear fit (brownish dashed line) is basically as good as the nonlinear fit — the brown dashed curve and the gray dashed curve fall on top of each other until we get out to the US. And over the entire range, the nonlinear fit falls inside the 90% confidence limits of the linear model [3]. In fact, the linear model is actually much better than the nonlinear model in terms of absolute error [4]:

RCA's nonlinear model (fit correctly) actually predicts US health care spending will be somewhere between $7000 per capita and $13000 (90% CL) — and $8000, solidly within one sigma, is right in line with the linear model. That means that unless we include the US we do not have any reason to select the nonlinear model here. Or another way — assuming the US is not an outlier, US is not an outlier.

You may ask why I haven't gone in depth on the rest of the avalanche of graphs that follow. Unlike a novel where an unreliable narrator can be interesting, in science it's anathema. You have to go for more than just the superficial honesty of not deliberately lying, but rather leaning over backwards to show that your biases aren't driving the conclusions. In short, this is an example of cargo cult science — and it tells us more about the person doing it than it does about the world.

But screw it. Let's forget about science. Let's listen to an internet rando. Let's say RCA's claim is true that the US is not an outlier — and that globally health care spending rises twice as fast as income. We've apparently traded a US-specific problem for an enormous global problem where health care rises faster than income and becomes more and more unaffordable for everyone on Earth. The US's medical bankruptcies are just the canaries in the coal mines of a growing global problem [5]. His laser focus on showing the US is not an outlier at all costs makes him miss the forest for the trees — I'm sure RCA didn't want to imply that global health care spending is on an unsustainable path. He seems to think spending more and more money on health care (despite "diminishing returns" [6]) is the epitome of civilization:

The typical American household is much better fed today than in prior generations despite spending a much smaller share of their income on groceries and working fewer hours. I submit this is primarily a direct result of productivity. We can produce food so much more efficiently that we don’t need to prioritize it as we once did. The food productivity dividend, as it were, has been and is being spent on higher-order wants and needs like cutting edge healthcare, higher amenity education, and leisure activities.I don't know about you, but I love going to the doctor [7].

...

Update + 5 hours

In case you might think I'm being unnecessarily harsh on RCA, please note a) that isn't the first time I've encountered him and b) this from the "discussion" of this blog post this evening (click to enlarge):

...

Update 2/22/2020

I am wondering if this might be a clearer demonstration of what I'm getting at here. I fit another nonlinear function to RCA's data (leaving the US out because we want to see if it's an outlier). It's a logistic function. Using this function here has some basis in economic theory — e.g. satiation points. At some point consuming health care is more of a hassle than a benefit, right? Only so many angioplasties you can have in a year. Well, at least that's a plausible model. If we drop RCA's data in, we get the brown-ish curve below:

This says the US (green dot) is overspending by about double at a point where it should be reaching satiation. I could write up a whole long blog about this, and since it matches RCA's curve (blue) for every country except the US most of the rest of his analysis would go through. The other countries in the world are on the growing part of the curve — it'd just change the conclusions about the US.

But I can't do this. At least, not in good faith — and definitely not leaning over backwards. I actually believe this picture is almost certainly more accurate. My uncertainty in the saturation level is about where the single prediction bands put it. However, I would be a charlatan if I tried to push this fit to the data and let it be used by others in policy discussions.

Sure, I might put up a blog post and say, hmm, interesting — let's see how the data looks in the future!

But I can't draw a conclusion — US health care spending is an outlier — like how RCA has done with his. That's what I mean by the plot being in bad faith.

...

Update 2/22/2020 part II

These graphs were made somewhat tongue-in-cheek, but they illustrate a bit of the problem with extrapolating the nonlinear fits as far out as the US — where does it stop? At what point do we stop saying that because a point falls in the gray band, we have to conclude it's not an outlier? (Click to enlarge)

A good summary of my argument is that we can't go as far as that green dot representing the US and claim we're leaning over backwards in being honest.

Additionally, the slope determined in the nonlinear fit are akin to elasticities in economics — the change in e.g. price vs quantity in elasticities of supply and demand (one of the earliest things I looked at with information equilibrium on this blog). I'd say it's a stretch to actually say slopes in this example are estimates of elasticities (we have aggregate macro data here, not micro data), but lets go with it. The thing is that 1) they are elasticities only where the difference in logs is approximately a percentage, and 2) estimating elasticities and applying that human behavioral result well beyond the data you measured is not scientifically supportable.

Let's look at x compared to a reference value of x₀ = 5. The blue line below is 100 × (log x − log x₀) aka difference of logs, while the yellow line is 100 × (x − x₀)/x₀ aka the percent difference. We can see how this approximation breaks down as you move away from a region:

Note that the US is about twice as far out on the graph as the highest point in the data — so in terms of the slope on the log graph representing an elasticity, we're well out of scope of the approximation.

And even if the approximation was still in scope, extrapolating the behavioral meaning of that elasticity all the way to twice the highest point in the data is even more problematic.

In a more down to earth example, we know that gas prices do not heavily impact consumption in the short run when they fluctuate at the 10-30% level. RCA's analysis is like extrapolating that finding to increases of 100% — if gas prices doubled, consumption would remain constant. That's iffy on its own. However, he takes it a bit further — if some data then showed the US didn't reduce its consumption when gas prices doubled (i.e. it was in line with that extrapolation), RCA's analysis would be claiming that gas consumption is actually perfectly inelastic (people everywhere don't care about the price of gas at all) instead of possible structural reasons the US didn't reduce supply (e.g. the US built roads and housing that locked in commuting and therefore gas consumption). The former is basically a conclusion derived from a single data point — like RCA's claim the US isn't an outlier.

...

Update 2/22/2020 part III

Per commenter rob below, here is that disallowed region (above the blue dashed line) and where RCA's curve intersects it:

I mean, if we're allowed to extrapolate to the green point, why can't we extrapolate all the way out to that intersection?

n.b. This is a scope condition (a limit of the region of validity of the model).

Footnotes:

[0] Sure, I'm also an internet rando (a random physicist you could say), but I give my real name and you can peruse my grad school papers and thesis here if you'd like. In the interest of leaning over backward, I can also say that I am quite biased towards the left of the political spectrum. However, I don't have really strong feelings about health care policy — I do think it should be free because of basic morality, but that doesn't necessarily mean I think it should be a smaller component of GDP, but maybe a plausible future is one where most of us work in health care instead of retail (the transition appears to be already happening). Other people have much better thoughts on health care policy than I do. I wrote a short book on my views of the political economy of the US that doesn't even mention health care except for the possible stimulus effect of the ACA, focusing instead on racism, sexism, and other social forces as drivers of the economy.

[1] "In case you're not already aware ..." is also the kind of language Trump uses when he just heard about something for the first time. [Edit: added + 30 mins.]

[2] In that Twitter thread from a year ago, I found out the equation RCA printed on the graph did not give the line presented in that graph. RCA said (a week later) it was about the plotting function label being unable to handle orthogonal polynomials:

I used a 3rd order polynomial with an orthogonal transformation -- poly() function in R. The labeling package isn't smart enough to transform the coefficients. No big deal.

Although this information did let me figure out what happened on RCA's graph, it's also the kind of word salad you get when a student is trying to confidently answer a question that they don't really understand. I imagine it took him that week to figure it out. Basically, RCA confused R's poly() coefficients with R's polynomial() coefficients. I'll use Hermite polynomials (not 100% sure how R chooses the orthogonal set) to show the difference.

A normal ("raw") regression fits (to third order)

p(x) = a x³ + b x² + c x + d

with the fit returning (a, b, c, d) while an orthogonal polynomial regression fits (using Hermite polynomials which is probably not what R is doing, but still illustrative)

p(x) = a' (x³ − 3 x) + b' (x² − 1) + c' x + d' · 1

with the fit returning (a', b', c', d'). where a = a', b = b', and c = c' − 3 a'. and d = d' − b'. It's quite valuable to do the latter, because it can reduce the covariance at each order — for example, Hermite polynomials of different orders are designed to have a zero overlap integral so adding each order doesn't affect the previous orders like it would for adding monomial terms at each order (x² looks a bit like x near x = 1, while x² − 1 doesn't as much near x = 1). But RCA isn't really doing an analysis where he shows increasing or decreasing orders where this process is most valuable — fitting a linear function, then fitting a quadratic and comparing the size of the new coefficients to see if adding the quadratic was warranted. If he had done that (as well as properly testing for the US as an outlier), he would have found that adding a quadratic term was not warranted unless the US was added.

However, I'm pretty certain RCA did not understand what R was doing until I called him out — at which point he went back to the documentation and tried to figure it out ... but still didn't understand it. If he had, he would have written something more like:

I used 3rd order orthogonal polynomials -- poly() function in R. I accidentally input the orthogonal poly coefficients in as raw poly coefficients. No big deal.

It's true that it's a simple mistake, but it also sheds light on who RCA is. Note that the common plotting package is in fact capable of handling using poly() in the linear model and printing the correct polynomial. But sure, it's that the package isn't smart enough, not that he made a mistake or didn't understand what he was doing.

[3] The error bands RCA is providing seem to be either less than one sigma or (more likely) are mean prediction bands (effectively where the new regression line will shift given a new data point) rather than single prediction bands (where an individual new data point might fall) which I tend give and what a typical person tends to think of when they see error bands.

[4] Wanted to keep the axes above consistent, but the single prediction error is pretty broad and can only be appreciated if you zoom out a bit. Click to enlarge.

[5] This may be true in a different way than RCA believes — rising US health care costs might be driving up health care costs around the world as we consume all the health care resources (Twitter thread here):

[6] To wit:

America’s mediocre health outcomes can be explained by rapidly diminishing returns to [health care] spending ...

[7] I love this quote:

Conversely, when we look at indicators where America skews high, these are precisely the sorts of [procedures] high-income, high-spending countries like the United States do relatively more of.

You know, things rich people like to do! Like coronary artery bypasses, hip replacements, knee replacements, and coronary angioplasties. Those are a much more fun use of your disposable income than a trip to Spain!

Overjoyed to finally see someone publish a good analysis of why the (long, long, *long*) RCA posts miss the forest for the trees. RCA has all the hallmarks of a programmer trying to do statistics (aka 'data science'): attractive plots, boundless confidence, and an inability to think deeply about causal structures within your data, or what precisely the math in the models you are using is actually doing.

ReplyDeleteThanks ... and *lol* :)

DeleteEntertainment expense are growing faster than income (despite diminishing returns in the amount of fun) and that a problem

ReplyDeleteYou, 1900

Are you equating health care with entertainment?

DeleteWhat is it with libertarian weirdos getting surgery for fun?

I think it is Jason who is missing the forest for the trees.

ReplyDeleteYou could remove the regression lines entirely and the "forest" would still be apparent: that (1) medical spending increases strongly with household income, and (2) this implies that high USA spending is not strong evidence of some unique disfunciton in the USA health system.

And I don't know why Jason says health care spending rising faster than income is neccessarily an "enourmous global problem." Lots of categories rise faster than income, for good reasons.

So the defense of RCA's analysis based on regressions is to say the regressions are irrelevant?

DeleteAnd (1) is kind of an empty statement. Health spending could easily grow faster or slower than income and still "rise with income". The latter is not a problem, which the former is.

The entire point of the blog post is that only way you can draw the conclusion (2) is by assuming conclusion (2) — it's question begging.

Thanks for the additional chart. I have a followup question.

DeleteRCA says 'the slope in the health expenditure-income plot below implies that a 1% increase in underlying value on the x-axis (income) predicts a 1.8% increase in value on the y-axis (health spending).'

This seems to be saying that as income rises any additional income will be increasingly spent on healthcare. While this does mean that health care spending rises faster than income I think it prevents healthcare from ever reaching 100% of spending and indeed it would mean that as income increases people get richer both in terms of healthcare and other goods (at least until the point where all additional income is send on healthcare). This would prevent healthcare spending from ever becoming 'unaffordable' (at least for society as a whole).

Am I interpreting RCA's statement correctly ? Are his charts perhaps inconsistent with this statement ?

Since income is larger in level, a 1% rise in income is larger than a 1.8% rise in health care spending until health care spending is about 50% of income.

DeleteAt €10,000 income and €1,000 health care spending, if income rises €100 then health care spending rises €18 — leaving €82.

At €100,000 income and €50,000 health care spending, if income rises €1,000, spending rises €900 leaving only €100.

And yes, at some point the curve would have to bend away from the y = x line instead of intersecting it — preventing health care spending from being more than %100 of income.

That was amazing, Jason. Thank you!

ReplyDeleteI have a question on: 'Let's say RCA's claim is true that the US is not an outlier — and that globally health care spending rises twice as fast as income''

ReplyDeleteAm I correct in thinking this would (if continued indefinitely) lead to 100% of income being spent on healthcare - at which point the trend would have to end ?

Yes, eventually. In fact, he says that on his blog:

Delete"... it’s entirely possible to spend an ever-larger share of income on health without reducing our real consumption elsewhere."

i.e. Eventually we will make $500,000/year median income and spend $450,000 of it on health care.

The disposable income measure he uses (i.e. AIC as a proxy for "disposable income") on the x-axis includes health care, so (aside from the funny bit about regressing x on x that I didn't get into) the values on the y-axis cannot exceed the values of the x-axis — putting essentially a wall at the y = x line.

I'll add a graph above in update III.

Hey, I read some other RCA posts (mainly about achievement gap stuff) and his arguments seem maybe solid but I want a good rebuttal. You don't need to make a post, just give me examples for where he gets wrong (other then the post you responded to).

ReplyDelete