Simon Wren-Lewis quotes Brad DeLong asking:

why models that are microfounded in ways we know to be wrong are preferable in the discourse to models that try to get the aggregate emergent properties right.

and continues

Why are microfounded models so dominant? From my perspective this is a methodological question, about the relative importance of ‘internal’ (theoretical) versus ‘external’ (empirical) consistency. ... So, for example, you will be told that internal consistency is clearly an essential feature of any model, even if it is achieved by abandoning external consistency.

Every time I hear these complaints about the hegemony of microfoundations, my jaw just drops. Here is David Glasner:

A macroeconomic model was inadmissible unless it could be explicitly and formally derived from the optimizing choices of fully rational agents.

The classes of theories that are eliminated by making such assumptions or following such a methodology is staggering. It would be as if physicists declared upon discovering various quantum or relativistic effects that went against classical mechanics that everything must now be described in terms of different kinds of "Newtonian gravities" acting on atoms.

That is not some exaggerated claim -- it is isomorphic to Glasner's description of the microfounded methodology. The atoms are agents, the optimizing choices (utility maximization) is the principle of least action and the Lagrangian formulation of classical mechanics. The quantum effects are things like the changing Phillips curve. There would have been some limited success -- electromagnetism looks a bit like Newtonian gravity with positive and negative charges. But the list of things it would have precluded is long ...

Quantum mechanics

Non-Abelian gauge theory

Special and general relativity

Topological effects

Phonons

Nuclear physics

Superconductivity

String theory

Antimatter

Dark energy

Thermodynamics

Magnetohydrodynamics

Thermal field theory

Radioactive decay

Neutrino oscillation

Black hole thermodynamics

Hubble's law

Chemistry

Aerodynamics

Lasers

Stress tensors in material science

Rank 2+ tensors in general

How the sun works

How the sun emits fewer electron neutrinos than observed

Why the sun doesn't irradiate you with X-rays

Why your electric oven doesn't irradiate you with X-rays

Emergent dimensions

Emergent degrees of freedom

Unruh effect

Entropic gravity

Superfluidity

Supersymmetry

Brownian motion

And many, many more ...

And as I've said before [link added], things like sticky prices sound like entropic forces for which there are no correct microfoundations. Just as there is no microscopic force that causes diffusion, there may be no microscopic force that causes prices to become resistant to macroscopic change (clearly there is no resistance to microscopic change).

That may be why the microfoundations, and hence economics, have lost touch with empirical reality (or Wren-Lewis's euphemism external consistency).

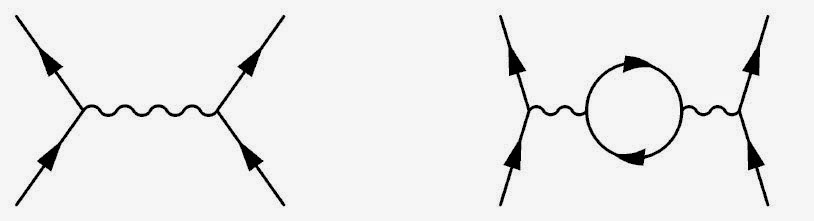

As a side note, in physics there is something that actually seems like the methodological hegemony of microfoundations. I'd call it the hegemony of effective field theory. Basically everything taught beyond undergraduate physics is taught as a field theory ... Feynman's path integral looks like a thermodynamic partition function, all of solid state physics is taught in terms of electrons, holes, phonons, and other quasiparticles. String theory is actually just a generalization of field theory -- replacing Feynman diagrams with a topological expansion of string amplitudes (a phonon-electron diagram can be see e.g. here):

|

| Tree level and one-loop Feynman diagrams. |

|

| Tree level and "one-loop" string scattering amplitude. |

However, this hegemony is born of astounding empirical success.

Modern macroeconomics is a bit like someone making all kinds of strong claims about the true state of the world. There are two typical futures of such a person: being hailed as a genius, or being placed in a straitjacket.

muth's rational expectations models won out because other models at the time weren't as good empirically (read im super sick of seeing adaptive expectations models) and more importantly the class of other models they were and we are willing to look at today is limited because they must translate morally correct decisions from the framework of the models to the empirical world.

ReplyDeleteyour model might out-predict microfounded RE models, but until you rigorously show conditions under which information equilibrium is morally relevant to individuals in the model it simply isnt going to be mainstream economics, and frankly it shouldn't be.

many of my professors have taught economics as a discipline of how agents should behave. 'should' as in how we ought to teach them to behave...this is why microfounded models are king. they helped to break down the severely misguided notion that economics can be broken apart into normative and positive aspects.

Hi LAL,

DeleteI'd agree with your statement:

"but until you rigorously show conditions under which information equilibrium is morally relevant to individuals in the model it simply isnt going to be mainstream economics"

.. in the sense of how information equilibrium would be (and seems to be) treated by mainstream economists (here is a post that is an example from a economics PhD student).

However the approach seems to indicate human decisions can be treated to a good approximation as random. If the information equilibrium approach is correct, not seeing human actions as random would be a serious impasse to understanding! That is an impasse that is in addition to the one I mention in the post above -- whole classes of potential theories cannot be obtained from a microfounded utility maximization approach.

From the outside (my perspective as a physicist), macroeconomists seem strangely attached to the idea the sum of millions of human actions is something that strongly depends on the model of those human actions.

In physics, this is never the case in tractable models (you could probably use this to define tractability [pdf]). In a sense, the insistence on microfoundations that matter at the macro scale is like insisting economic models must be intractable. At a bare minimum, it means that any economic model must operate in a multi-million dimensional space.

Sorry for so many physics analogies, but claiming human behavior matters at the macro scale is like an claiming that all of the properties of a Helium atom must matter for an ideal gas. Not only is this not true, it sets you on a path towards an intractable model of the wavefunction of 10^23 particles.

Some pieces of human behavior must "integrate out".

maybe lucas is wrong and regime shifts cannot be microfounded, and that could possibly be because the relevant behavior gets integrated out.

Deletein fact i think the biggest missing part of current academic econ research is understanding what kinds of behavior fail to coordinate behavior in a way to cause or react to a regime change. and i think these are emergent properties due to 'information frictions'.

but i think you should spend more time with Muth, Lucas (especially the lucas islands models), Fama, and Hansen...or just read Cochrane's asset pricing book...very little in their ideas seems like it will go away with the information theory results, in fact I am convinced you have mostly discovered another way to justify the rational expectations paradigm...and interestingly i think you have formalized that rational expectations gives us many of the impossibility results (like sonnenschein-mantel-debreu) that are a bit of a chore to teach through the utility maximization approach (although we all suffer through them in grad school)

i really wish you would try your hand at the lucas islands signal extraction problem...his nobel lecture is a great place to start so that you can see a pretty fair assessment of its generalizations...and potentially a place to say pick an arrow debreu equilibrium out of many...

I'd agree that the information equilibrium (IE) approach won't make a lot of the ideas go away -- in fact, there doesn't seem to be much new in the approach at all! At least in terms of the mechanics. In the thermodynamic limit, one takes P = ⟨P⟩ + ɛ with ɛ → 0. This is formally identical to rational expectations ... so in that sense it does justify the RE approach.

DeleteThe interpretation is quite different, though. In RE, agents in a sense know the model and so plan for the model results. In IE it is a consequence of the central limit theorem and that economies are in a sense "large". Even the EMH makes it -- the idea that prices are maximally uninformative is precisely the principle of maximum entropy.

In that sense, information equilibrium won't alter many of the formal results, just their interpretation.

I will have a look at the Lucas Islands model ... I'm a bit slow with most technical economics papers since I'm not yet fully fluent in the jargon or the notation.

sorry i can be super slow in understanding people...reflecting on the comments you have made to me and others, im starting to see what your argument is not about at least...

Deletethe lucas islands models are pretty straightforward, a local price signal and an aggregate price signal...i like the presentation in the "econometric policy evaluation: a critique"... as the origin of the lucas critique, I stick pretty closely to it for understanding that the need for microfoundations is the relation to the problems of policy formation...you seem to have purer intentions of ontology and epistemology in mind...but academic econ cant afford to be focused as such...it's a precarious place where anything you say can and will be stapled onto a political agenda

so...so far my big picture view of what we are talking about is that Macroeconomics as a theoretical and empirical study of large (mostly free as opposed to command organized) systems doesn't need micro-foundations to predict certain features like sticky prices and simple functional form relationships between aggregate variables...on the other hand I insist Macroeconomics as a moral and practical discipline cant be detached from well defined agents because of the moral lessons of toy models like those of the lucas islands (though i think in retrospect they are much more relevant than the rbc and new keynesians thought in the 80s-today and can be salvaged now that we know a lot more about information in markets)

The thing is that we can observe those microfoundations (e.g. in cognitive psychology, ethnography, etc.). If "macro" is an emergent property of those micro practices, then to make sense of macro--and maybe change it--we need to understand the micro and how it aggregates into a "macro." Now, this might not be how things work in your neck of academe, but you are already on thin ice in thinking that one way of doing "science" applies everywhere. Your models here are interesting, but don't presume that this means that we map physics onto studies of the social.

ReplyDeleteI actually completely agree with this. What I am discussing is a very narrow meaning of "microfoundations" -- mathematical models of optimizing agents that are aggregated into macro system.

DeleteIt is possible (even likely) that human psychology, social institutions etc strongly matter, in which case the "information equilibrium model" that I'm looking at here just tells us that information equilibrium between e.g. supply and demand ... I(S) = I(D) .. fails as an assumption.

However, if you can add up mathematical models of economic agents to get a tractable model of a macroeconomy some very deep mathematics tells us that the details of those agents can't matter (compare the dimension of the two spaces the models work in -- one would have millions of dimensions for each agent an the other would have 10's of dimensions for each macroeconomic variable like NGDP, etc).

That is a property of the mathematics (and the only reason I'm sticking my nose where it doesn't belong), but maybe math is useless for economics ... for any number of reasons: the aggregate model is intractable, the aggregate model cannot be solved during the lifetime of the universe, there is no mathematical description of an agent, there is no way to observe enough agent behavior in a particular policy regime to produce an agent model, ... all sorts of reasons.

In a (exaggerated) sense, either macroeconomics doesn't depend strongly on micro or macroeconomics should become a subfield of sociology and/or history.

What do you think of the following post by Krugman?

ReplyDeletehttp://krugman.blogs.nytimes.com/2013/12/21/uber-and-the-macro-wars/?_php=true&_type=blogs&_r=0

"Someday, one suppose, we’ll be able to put it all in equations — after all, everything is quantum mechanics in the end."

Spoken like a true reductionist :)

DeleteBut realistically quantum microfoundations to model even a single cell would probably require quantum computers that operate on scales of modern compute clusters. I haven't kept up with the literature, but I think they've only done a couple of OPs with a couple of qubits.

Overall, Krugman is saying something similar to the point I am trying to make -- at the end he asks:

"Can you live with that reality, and accept the notion that not everything you put in your model has microfoundations?"

Because if the macro effects you observe are caused by entropic forces you're not going to get it right from microscopic forces. You may capture the effect, but you shouldn't try to interpret it (e.g. I think Calvo pricing captures nominal rigidity, but doesn't make sense from a micro standpoint).

This is not to say agent based modeling on large computers is a futile task! You can still get entropic effects even if you don't add them in ... which I did here. There are no forces of any kind -- I just added or subtracted points to one side or the other and they just move randomly.