_________________________________

Prediction: multiple indicators

https://informationtransfereconomics.blogspot.com/2016/04/celebrate-this-blogs-birthday-with.html

[US core CPI inflation, RGDP, interest rates from 2014 to 2016 = 2 years]

updated 04/2016

Status: Successful☺

_________________________________

Prediction: interest rates

https://informationtransfereconomics.blogspot.com/2016/05/doing-economists-work-only-better.html

https://informationtransfereconomics.blogspot.com/2016/11/the-surge-in-10-year-rate.html

https://informationtransfereconomics.blogspot.com/2017/02/monetary-base-and-interest-rate.html

https://informationtransfereconomics.blogspot.com/2017/08/who-has-two-thumbs-and-really-great.html

https://informationtransfereconomics.blogspot.com/2017/10/10-year-interest-rate-forecasts-in-us.html

[US long term interest rates from 2015 until 2025 = 10 years]

updated 10/2017

Status: Ongoing

_________________________________

Prediction: unemployment rate (vs FRBSF)

https://informationtransfereconomics.blogspot.com/2017/01/unemployment-forecasts.htmlhttps://informationtransfereconomics.blogspot.com/2017/02/unemployment-forecast-update.html

https://informationtransfereconomics.blogspot.com/2017/04/unemployment-rate-conditional-forecast.html

https://informationtransfereconomics.blogspot.com/2017/07/a-few-forecast-updates.html

https://informationtransfereconomics.blogspot.com/2017/09/recession-detection-algorithm-update.html

https://informationtransfereconomics.blogspot.com/2018/01/labor-market-update-comparing-forecasts.html

[US unemployment rate 2017 through 2018 = 2 years]

updated 01/2018

Status: Ongoing

_________________________________

Prediction: NGDP

https://informationtransfereconomics.blogspot.com/2016/01/predictions-and-prediction-markets.html

https://informationtransfereconomics.blogspot.com/2017/01/updating-ngdp-path-prediction.html

https://informationtransfereconomics.blogspot.com/2017/04/update-to-predicted-path-of-ngdp.html

https://informationtransfereconomics.blogspot.com/2018/01/another-successful-forecast-ngdp.html

[US NGDP from 2015 to 2018 = 3 years]

updated 01/2018

Status: Successful☺

_________________________________

Prediction: Inflation versus DSGE model

http://informationtransfereconomics.blogspot.com/2015/10/core-pce-inflation-update.html

http://informationtransfereconomics.blogspot.com/2015/11/speaking-of-math.html

http://informationtransfereconomics.blogspot.com/2016/02/model-forecast-update-core-pce-inflation.html

http://informationtransfereconomics.blogspot.com/2016/04/update-to-2014-it-model-inflation.html

http://informationtransfereconomics.blogspot.com/2016/08/ie-vs-ny-fed-dsge-model-update.html

http://informationtransfereconomics.blogspot.com/2017/01/an-inflation-forecast-comparison-update.html

https://informationtransfereconomics.blogspot.com/2017/11/comparing-my-inflation-forecasts-to-data.html

https://informationtransfereconomics.blogspot.com/2018/01/losing-my-vestigial-monetarism.html[US core PCE inflation; comparison with NY Fed DSGE model]

updated 01/2018

Status: Rejected ☹

_________________________________

Prediction: EU inflation

http://informationtransfereconomics.blogspot.com/2016/04/blog-birthday-week-continues-another.html

[EU inflation (HICP) sans energy and seasonal food]

updated 04/2016

Status: Successful☺

_________________________________

Prediction: PCE inflation versus corridor model

http://informationtransfereconomics.blogspot.com/2016/02/model-forecast-update-core-pce-inflation.html

http://informationtransfereconomics.blogspot.com/2016/04/update-to-2014-it-model-inflation.html

[US core PCE inflation, comparison with David Beckworth's corridor model -- to 2020]

updated 04/2016

Status: Ongoing

_________________________________

Prediction: Canadian inflation

http://informationtransfereconomics.blogspot.com/2017/02/worthwhile-canadian-prediction-comes.html

[Canada CPI inflation (undershooting)]

updated 02/2017

Status: Successful☺

_________________________________

Prediction: Japanese price level

http://informationtransfereconomics.blogspot.com/2016/01/updates-to-some-ongoing-forecasts.html

http://informationtransfereconomics.blogspot.com/2016/01/the-bojs-macroeconomic-experiment.html

http://informationtransfereconomics.blogspot.com/2016/02/it-model-forecast-update-for-japan.html

http://informationtransfereconomics.blogspot.com/2016/08/japan-lack-of-inflation-update.html

[Japan "core-core" price level and inflation to 2020/2025]

updated 08/2016

Status: Ongoing

http://informationtransfereconomics.blogspot.com/2017/03/the-mystery-of-japans-inflation.html

http://informationtransfereconomics.blogspot.com/2017/07/a-few-forecast-updates.html

[Japan "core-core" price level to 2020 with dynamic equilibrium model]

updated 07/2017

Status: Ongoing

_________________________________

Prediction: UK exchange rate

http://informationtransfereconomics.blogspot.com/2016/04/blog-birthday-week-continues-another_29.html

[Euro GBP (€-£) exchange rate]

updated 04/2016

Status: Successful☺

_________________________________

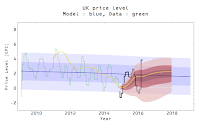

Prediction: UK inflation

http://informationtransfereconomics.blogspot.com/2016/05/update-of-uk-inflation-prediction.html

[UK CPI, comparison with the Bank of England]

updated 05/2016

Status: Ongoing

_________________________________

Prediction: monetary base/interest rates

http://informationtransfereconomics.blogspot.com/2016/01/post-hike-monetary-base-projection.html

http://informationtransfereconomics.blogspot.com/2016/01/the-10-year-treasury.html

http://informationtransfereconomics.blogspot.com/2016/02/the-long-and-short-of-interest-rates.html

http://informationtransfereconomics.blogspot.com/2016/03/interest-rate-and-monetary-base-updates.html

http://informationtransfereconomics.blogspot.com/2017/02/monetary-base-and-interest-rate.html

http://informationtransfereconomics.blogspot.com/2017/02/monetary-base-update.html

http://informationtransfereconomics.blogspot.com/2017/07/a-few-forecast-updates.html

[US monetary base]

updated 07/2017

Status: Ongoing

_________________________________

Prediction: lag model of CPI inflation

http://informationtransfereconomics.blogspot.com/2016/01/updates-to-some-ongoing-forecasts.html

[US core CPI and PCE inflation to 2018]

updated 02/2017 (at 11/2015 link)

Status: Rejected (t < 1 year) ☹

Status: Ongoing, (t > 1 year)

_________________________________

Prediction: Swiss CPI

https://informationtransfereconomics.blogspot.com/2016/02/another-win-for-it-model-switzerland.html

[Swiss CPI]

updated 02/2016

Status: Successful ☺

_________________________________

Prediction: CLF participation rate

https://informationtransfereconomics.blogspot.com/2017/09/date-update-civilian-labor-force.html

https://informationtransfereconomics.blogspot.com/2018/01/labor-market-update-comparing-forecasts.html

[US CLF participation rate]https://informationtransfereconomics.blogspot.com/2017/09/date-update-civilian-labor-force.html

https://informationtransfereconomics.blogspot.com/2018/01/labor-market-update-comparing-forecasts.html

updated 01/2018

Status: Ongoing

_________________________________

Prediction: JOLTS

https://informationtransfereconomics.blogspot.com/2018/01/happy-jolts-data-day.html

[US JOLTS data]

updated 01/2018

Status: Ongoing

_________________________________

Prediction: US rental vacancies

https://informationtransfereconomics.blogspot.com/2017/04/dynamic-equilibrium-rental-vacancy-rate.html[US rental vacancies]

updated 4/2017

Status: Ongoing

_________________________________

Let me know if I've forgotten any ...

I wonder how the IT model relates to private sector debt levels in the economy. My predictions are similar to yours but I come at it from a different framework, Large privates sector debt and asset values in relation to GDP means that the economy cannot sustain high interest rates. And they also exert deflationary pressures in many ways.

ReplyDeleteI don't know offhand -- I'd have to look into it. The first order analysis doesn't lead anywhere immediately obvious ...

DeleteIf N is aggregate demand and D is the supply of debt, then we'd have an equation like

p = dN/dD = k (N/D)

But N/D doesn't look like anything I am immediately familiar with that I could see as functioning as the abstract price p ...

https://research.stlouisfed.org/fred2/graph/?g=1UPZ

I'd have to give it some more thought.