I've been thinking about how expectations can set macroeconomic variables without "concrete steps", and in particular Nick Rowe's analogy with daylight savings time. I had some brief interaction with Nick in comments on my post here and this can be seen as an counterargument to this post by Nick.

Nick puts forward two analogies where we achieve a real macro outcome but we don't know what the concrete steps are (or there aren't any concrete steps): driving on the right and daylight savings time. In these situations, the government sets an expectation and everyone complies because everyone thinks everyone else will comply (in this model). This motivates the same logic applying for NGDP (and elsewhere inflation) targeting.

The trouble I've been having with this argument comes down to the fact that we as individuals choose which side of the road to drive on or to set our clocks back. Individuals have the power to set their clocks to any time or drive on either side of the road, and individuals enact the concrete steps. Individuals can't turn a wheel or push a button to set inflation or NGDP.

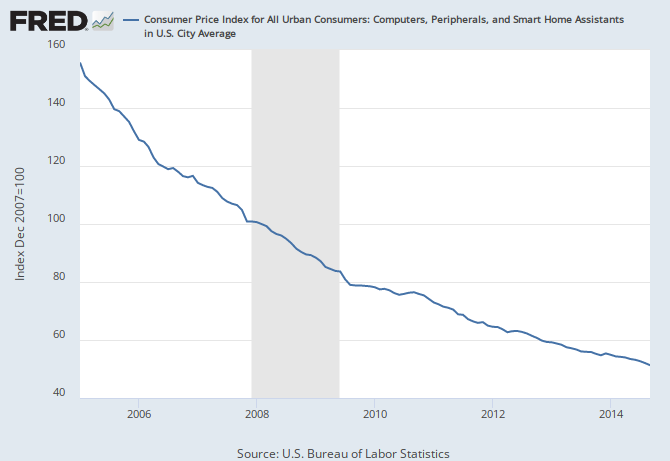

If the central bank set an inflation target and everyone decided to set their prices to rise at 2% per year, then the above analogies seem appropriate. In some cases that could be true: cost of living adjustments, long term contracts, investment decisions, buying a house, etc. However, we as individuals (or even firms) don't make all the choices involved in setting inflation. Some goods actually decrease in price (here is the CPI for computers):

This would be akin to whole segments of the population setting their clocks back when everyone else sets them forward. Additionally, "hedonic" and "quality" adjustments adjustments are made to CPI [1]. The owner of a restaurant can't decide to have prices rise at 3% while having people enjoy the food 1% more. No one can make technology improve based on expectations alone (or can they?).

Unlike daylight savings time or driving on the right, the concrete steps required to enact the inflation or NGDP expectations set by central bank are out of the individual's hands. This is why I reside on the concrete steppes and believe that physical currency ("M0") sets inflation [2], with a changing, but concrete [3], definition of the unit of account.

[1] PCE inflation measures are highly correlated with CPI and chained CPI, so it would be remarkable if they represented completely independent processes. Without loss of generality, let's stick to CPI inflation.

[2] Empirically, not ideologically -- if it was M1, MB, MZM or any other definition of money, that would be fine by me.

[3] It's very concrete -- the factor is given by the information transfer index and is explicitly κ = (log M0/c) / (log NGDP/c).

I thought I would try to understand your reference 3. No luck in goggling

ReplyDeleteκ = (log M0/c) / (log NGDP/c) or "information transfer index"

Could you point a lazy guy like me to some explanation?

Sure thing -- here is the theory behind the index:

Deletehttp://informationtransfereconomics.blogspot.com/2014/03/how-money-transfers-information.html

Here is another look at it:

http://informationtransfereconomics.blogspot.com/2014/06/money-unit-of-information-and-medium-of.html

The "information transfer index" is something like a conversion factor between different units of information; in this case it converts "money information" (M0) into "NGDP information".

Thanks!

ReplyDeleteI took a quick read of the first reference but it will take much more than a quick read to understand!

"believe that physical currency ("M0") sets inflation"

ReplyDeleteWhy do you believe that? Isn't it more likely that currency in circulation increases because prices rise rather than currency in circulation somehow causing prices to rise ?

or alternatively, currency in circulation increases because people are spending more, not that people spend more because currency in circulation increases...

DeleteThat is a good question. In this model, M0 and NGDP set each other -- one rising tends to make the other rise. Because of this, in a sense, causality goes both ways with the price level (this link talks about interest rates, but it's a similar argument):

Deletehttp://informationtransfereconomics.blogspot.com/2014/05/causality-in-information-transfer.html

A rising price level causes people to demand more currency and additional currency causes a rise (most of the time) in the price level.

Really what is happening in this model is that with additional currency, the potential states of the economy that have higher inflation become more likely. And higher inflation states of the economy require the additional currency in order to stay in existence ... otherwise inflation will fluctuate back to a lower inflation state.

And higher inflation states of the economy require the additional currency"

DeleteI'm not sure why that should necessarily be the case. It's possible to imagine a future in which there is no physical currency. In that case, things like reserve deposits at the central bank would be the only form of base money.

That would be a possibility -- it would change the definition of the unit of account from a piece of paper to some bits on a computer somewhere. The question is whether all electronic money would be the same (e.g. the stuff in our bank accounts that goes into the measures M1 and M2), or whether just central bank reserves defined money.

DeleteThere would likely be a 'monetary regime change', which I've noted on several occasions ... here for example:

http://informationtransfereconomics.blogspot.com/2014/09/the-us-economy-1798-to-present.html

I also discussed the idea of electronic money with Tom Brown in comments. I am not 100% certain what happens when 'MB' becomes all reserves ... but it would definitely lead to a change.

it could be possible for non-banks to hold central bank accounts, or for central banks to issue a form of digital currency like bitcoin.

DeleteBut anyway, I don't really see why higher inflation states necessarily require additional physical currency. I tend to use my debit card wherever I can, whereas in the past I would have always used cash. I don't see why using cards would be less inflationary than using physical cash.

To tell the truth, I agree that there doesn't seem to be any good reason to pick M0 over M1 (or MZM) a priori. The reason I like M0 isn't ideological (in fact, the whole monetarist view seems to be quite a bit to the right of my personal politics) -- I like M0 because it does an amazing job of explaining inflation in the information transfer model:

Deletehttp://informationtransfereconomics.blogspot.com/2014/02/this-model-is-sufficiently-awesome-to.html

http://informationtransfereconomics.blogspot.com/2014/02/models-and-metrics.html

That's the only reason I emphasize physical currency -- it fits the data far better than other measures (with this model):

http://informationtransfereconomics.blogspot.com/2013/07/all-your-base.html

Now why is it physical currency, rather than say the money created by fractional reserve banking (e.g. M1, M2 and MZM)? I can't say with certainty ... the reason for choosing M0 is empirical. But I have some ideas that may or may not be right.

M1, M2 and MZM are better correlated with NGDP, which I believe gives a hint. They are medium of exchange measures. M0 works best in the inflation model because it defines the unit of account. Physical currency is a bit like the kilogram model in Paris.

I talk more about this here:

http://informationtransfereconomics.blogspot.com/2014/06/money-unit-of-information-and-medium-of.html