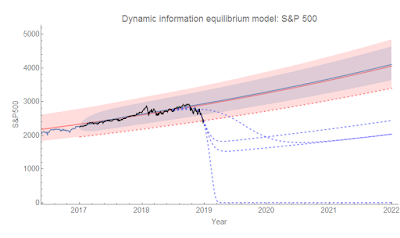

The US markets are closed today for the holiday, but the Nikkei dropped 5% (the Nikkei, however, is far more volatile than the US markets so this doesn't represent anything too out of the ordinary). I've updated the S&P 500 counterfactuals based on the latest data (keeping the "lol capitalizm iz doomd" fit that goes to zero because I love dark humor):

Funny enough (again, dark humor) the unconstrained fit now matches up with "median shock amplitude" fit (the two middle dashed blue curves are basically on top of each other). The truth is that fitting the leading edge of the data to a logistic function (and then taking the exponential) is not terribly stable, so expect many many revisions [1] to that counterfactual until we are about 1/2 the way through the shock.

Here are the Nikkei and the NASDAQ (the latter is pretty similar to the S&P 500). Click to enlarge:

...

Update 26 December 2018

And today it jumped back up a bit. New unconstrained counterfactual amplitude is now a bit smaller than the median shock. Probably a good place to link to this post about volatility regimes. Click to enlarge:

...

Update 7 January 2019

The estimates are back near the originals when we incorporate the recent gyrations:

...

Footnotes:

[1] For an example, see the undershooting and overshooting on the estimate of the size of the Great Recession in the unemployment rate data (click to enlarge):

No comments:

Post a Comment

Comments are welcome. Please see the Moderation and comment policy.

Also, try to avoid the use of dollar signs as they interfere with my setup of mathjax. I left it set up that way because I think this is funny for an economics blog. You can use € or £ instead.

Note: Only a member of this blog may post a comment.