After reading Noah Smith's post on Abenomics (approximately) one year out, I thought I'd update the model results for Japan to see if the information transfer model is still doing a fair job when compared with the data. I noticed something in the results that disturbed me, and I realized that maybe the base including reserves was not the right money supply for the price level model P:NGDP→MB. Here are a few graphs of the price level (green) for countries (US, Japan, UK and EU) conducting quantitative easing (QE) and the model calculation (blue):

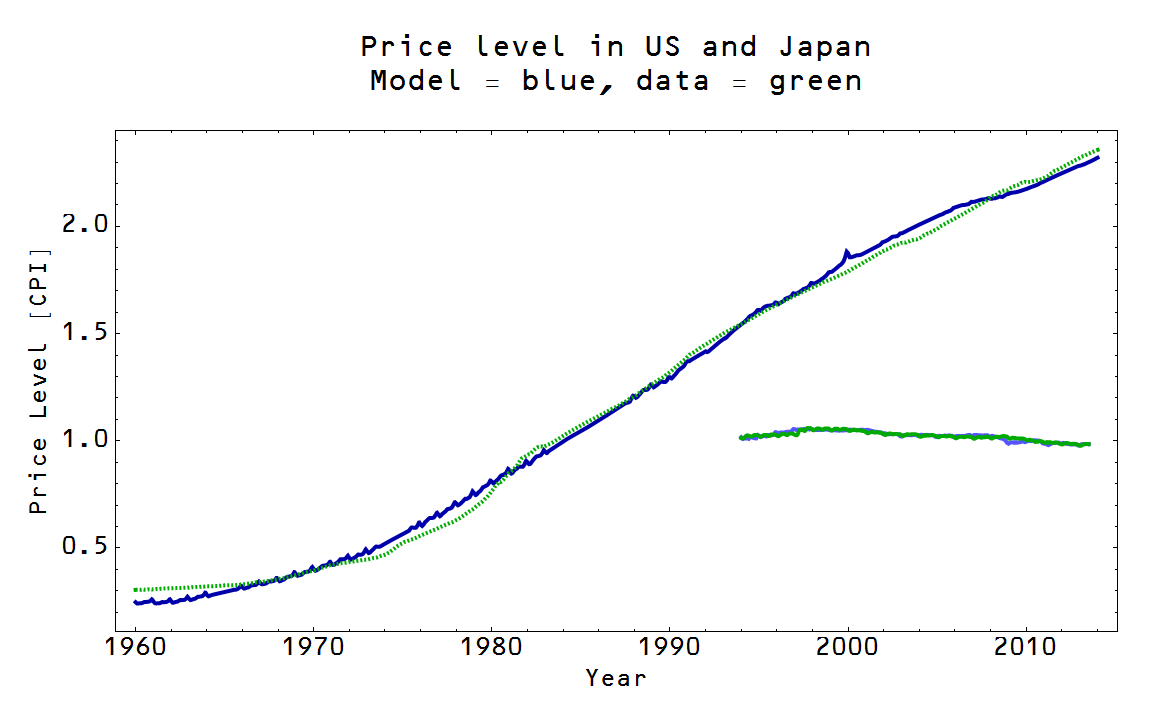

Note the red circles: the information transfer model seems to be overstating the amount of disinflation/deflation that is actually occurring in a rather systematic way. This is what disturbed me and so I decided to look at just the currency component of the base. This appears to do much better with the price level. Here for example are the Japan and the US model calculations using the currency component (sometimes referred to as M0):

This is pretty strong evidence that the monetary base should only include currency when attempting to model the price level. However! The monetary base including reserves is necessary to describe interest rates. If you use just the currency component of the base, you get a much worse fit for recent years. Here are the model results (blue uses the currency component, red uses currency + reserves and green is the US 3-month interest rate):

Therefore the appropriate markets are r:NGDP→MB for the interest rate and P:NGDP→M0 for the price level. There are a couple of points I'd like to make:

- It appears as though the most fundamental definition of money (actual printed/minted currency) is the best money supply for use as the unit of account (information transfer index, κ) and medium of exchange (information transfer market, P:NGDP→M0) to define the price level. Additionally, reserves have been typically small for most of the time series data, so there is actually little impact on the earlier information transfer model results. However, I will have to revise some the results; that will constitute a series forthcoming posts.

- Abenomics appears to not have affected the currency component of the base, so it is unlikely it has made a significant impact on inflation except maybe on interest rates (real and/or nominal). Macro data is again pretty uninformative.

In honor of my error (discovery) in using the monetary base, let's have some music:

No comments:

Post a Comment

Comments are welcome. Please see the Moderation and comment policy.

Also, try to avoid the use of dollar signs as they interfere with my setup of mathjax. I left it set up that way because I think this is funny for an economics blog. You can use € or £ instead.

Note: Only a member of this blog may post a comment.